- Newsroom

- >

- Itamar Benedy On What Impact The Microsoft and Activision Blizzard Deal Will Have As We Look Ahead To 2024

Itamar Benedy On What Impact The Microsoft and Activision Blizzard Deal Will Have As We Look Ahead To 2024

We recently caught up with Anzu’s Co-Founder and CEO, Itamar Benedy, to look back at the closure of the biggest gaming deal of all time and forward at what impact it could have as we think about what 2024 might have in store.

Q: Let's dive straight in. Why do you think so many people were surprised when this deal was first announced?

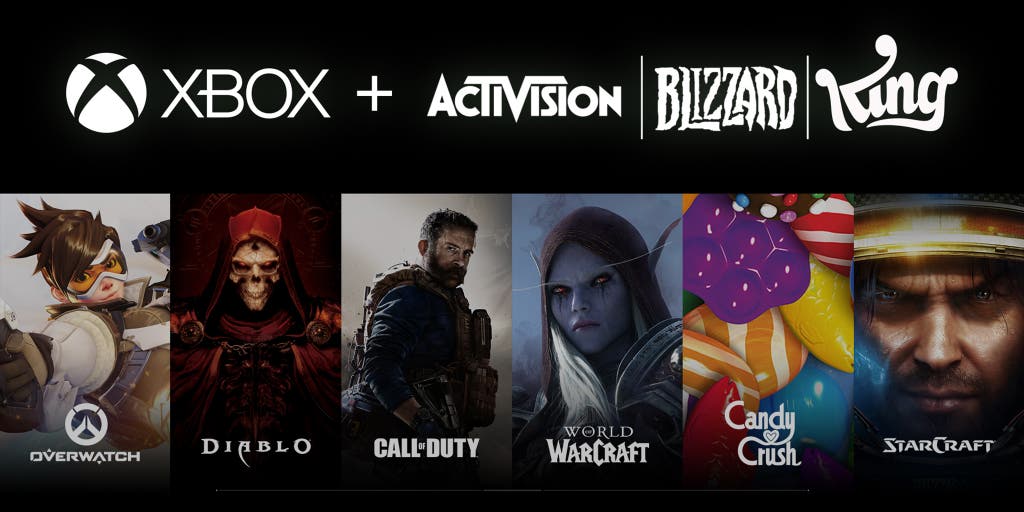

Many people were surprised by the $69BN Microsoft announced it would pay for Activision Blizzard because they still don’t understand how big this market has become. Globally, the market is expected to exceed $490BN by the end of the year, and every month, this number continues to climb.

The gaming and advertising industries are multi-billion dollar markets. However, there is still little overlap between them. This means there is still a huge opportunity for innovation and collaboration between them, and this gap is one of the reasons Anzu exists. The closure of the Microsoft and Activision Blizzard deal signals a shift and demonstrates that big players from both industries are starting to understand the massive opportunities at its intersection.

Q: Can you talk a bit more about that intersection and what you think this deal means for the future of advertising in games?

Last July, we heard about Unity’s plan to acquire ironSource, the first in a series of significant deals to move the advertising and gaming industries closer together. However, this Microsoft deal is on another level, and we have never seen a company so embedded within advertising invest so much in the gaming space. Clearly, big tech sees the need for the gaming business model to be updated, and advertising can fill that gap.

If you think about it, it is unbelievable that Candy Crush generates more revenue than Call of Duty or that Call of Duty’s mobile game brings in more dollars than the console and PC mainstream titles. One of the main reasons for this is that well-established ad models are in place for many casual mobile titles.

An HD game, which is a premium and exciting experience, should generate more revenue than a casual-based title, but 9/10 it doesn’t. This will inevitably change as ad-funded monetization practices become more commonplace in PC and console titles. However, these platforms are considered premium, and advertisers who want to enter them must think carefully about how they can elevate and add to the experience rather than disrupt it.

This deal is also interesting because if we look at the advertising landscape, we have Google, which dominates in search, Meta, which dominates in social media, and Amazon, which dominates in retail. However, there is currently no ad powerhouse for gaming, and by doing this deal, Microsoft has become the top contender for this title.

Q: What about Xbox Game Pass? Where does that come into all of this?

When Microsoft launched Xbox Game Pass, they saw an opportunity to bring a Netflix-style model to the gaming world. However, if we look at Netflix today, their ad-funded tier brings in much more revenue per user than any of their other offerings, emphasizing the opportunity that a cheaper product with advertising has over a paid-for product. With the current state of the world and the economy, incorporating an advertising model into Game Pass makes a lot of sense and will help generate more revenue per subscriber.

-9.jpg?width=1605&height=862&name=Copy%20of%20BLOG%20(1605%20%C3%97%20862%20px)-9.jpg)

Q: Do you think we will we see any more big gaming acquisitions or mergers next year?

Many of the globe’s biggest corporations are looking to gaming because they see this opportunity. We can see this from the rumors that a number of companies are circling EA, including Amazon, Apple, NBCUniversal (one of Anzu’s investors), and Disney. Overall, this is excellent news and exciting for advertisers because as more HD games consider and adopt the ad-funded business model, advertisers will have access to more premium environments.

It will also give them access to audiences who play across PC and console, many of which are high earners with deep pockets who spend a considerable amount of time gaming. Additionally, many game companies need this new business model as it continues to become more and more challenging to convert players to payers.

In summary, the closing of this deal marks an incredibly exciting time, and one that Anzu sits at the heart of and as we continue to see the repercussions of this shift on the industry, it is only going to become more apparent that the advertising industry needs the gaming industry, and the gaming industry needs the advertising industry.

Nick is Anzu's Content Lead. As a gamer with a background in AdTech, he has a unique perspective on the industry and the in-game advertising sector.